Who uses pControl™ Asset Allocation?

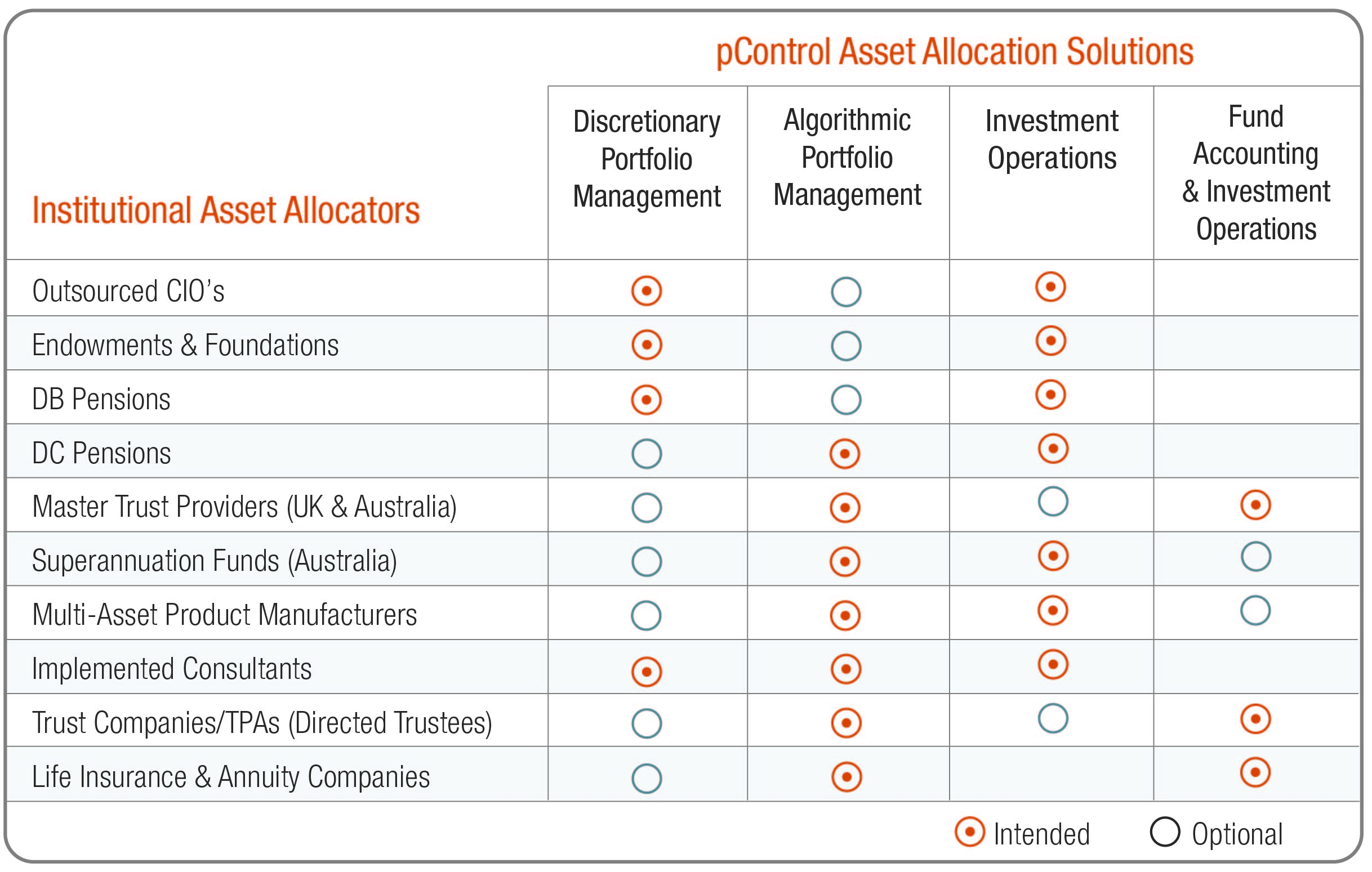

pControl™ Asset Allocation is intended for Institutional Asset Allocators who:

- Undertake Asset Allocation or Portfolio Management into pooled investment products as part of their fiduciary duties as an Asset Owner

- Provide Asset Allocation or Portfolio Management services into pooled investment products under a fiduciary management arrangement between themselves as an Asset Manager and their client, an Asset Owner

- Provide Portfolio Implementation services into pooled investment products under a directed arrangement between themselves as an Implemented Consultant, or as a Third Party / Retirement Services Provider

The following table shows how these tailored solutions address the needs of Institutional Asset Allocators.

What is pControl™ Asset Allocation?

pControl™ Asset Allocation is a set of complete solutions designed to serve the different requirements of Institutional Asset Allocators:

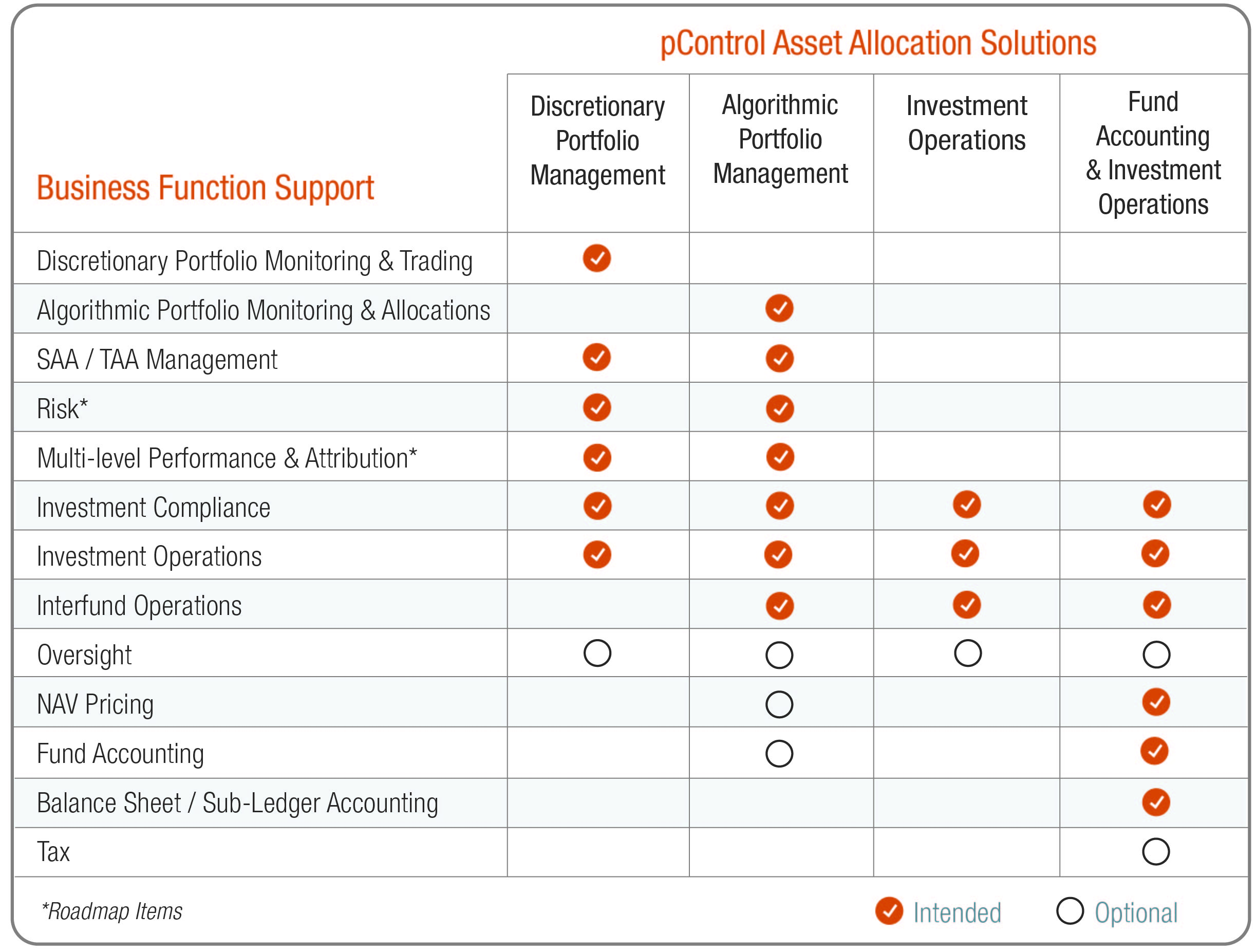

- Discretionary Portfolio Management supports the asset allocation needs of full or hybrid discretionary managers investing in open architecture funds, alternative investments, separately managed segregated accounts, or proprietary products across multiple clients, managers, sub-advisors, or custodians.

- Algorithmic Portfolio Management supports the asset allocation needs of DC pension providers and product manufacturers with product or investment option centric asset allocation models implemented via cross invested interfund vehicles, requiring fully automated allocations, or partial discretion to manage within bounds.

- Investment Operations supports the IBOR and related needs of Investment Operations teams who require ‘middle-office automation’ of cash allocation, rebalancing, order management and unitization, with associated support for investment compliance and interfund operations.

- Fund Accounting & Investment Operations supports the accounting (ABOR) and operational (IBOR) needs of Life, Pension and Annuity providers who operate on balance sheet unit linked investments requiring NAV Pricing, Unitization, Fund and Sub-ledger Accounting, combined with Investment Operations.

How does pControl™ Asset Allocation fit my business?

The following table outlines the Business Functional Coverage for each pControl™ Asset Allocation solution profile.